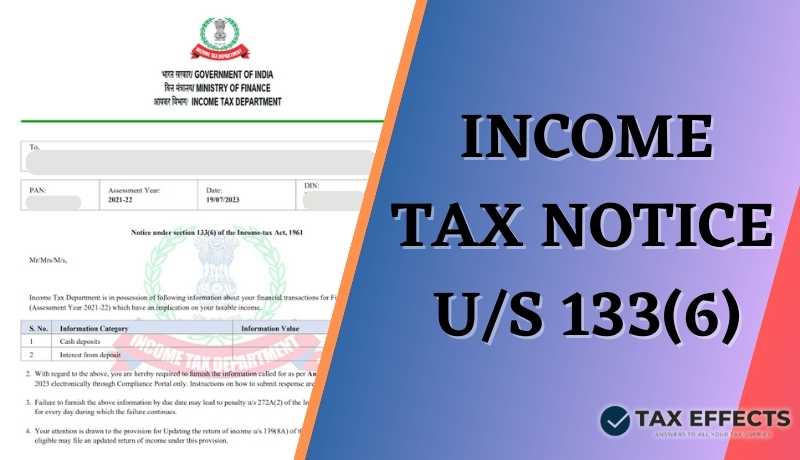

In the last few months, we have seen numerous cases where income tax notices have been issued by the income tax department. Out of these notices, two notices are most common: (1). 148A – Income Escapement Notice; (2) 133(6) – Power to Call for Information notice. In this article, we would be understanding in details about the 133(6) notice.

Section – 133(6) – Power to call for Information by Income Tax Authorities. Notice u/s 133(6) of Income Tax Act,1961 pertains power to income tax authorities to require any person to furnish information or documents relevant to a tax inquiry or proceeding from the taxpayer himself as well as third parties such as banks, employers or other relevant sources, to gather details about a taxpayer’s financial transactions.

This notice aims to ensure accurate reporting of income & prevent tax evasion. Tax authorities can use this information to cross-verify the taxpayer’s claims & identify any discrepancies between reported & actual financial activities.

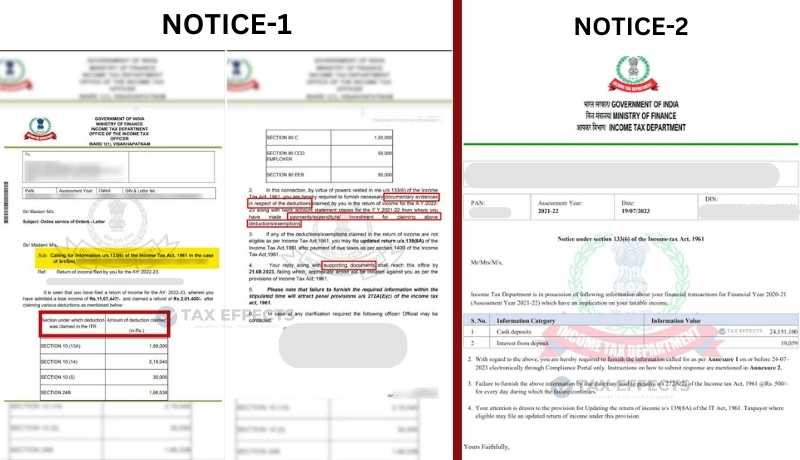

In the recent days, the department has mostly use this section for asking documentary evidences for claiming excess/bogus deductions, exemptions, claim fake expenses, clarification about making excess credit card payments etc. Here are the few samples of the notices:

Some of the important points to be considered in Section – 133(6) notice are as follows:

- Information collected here by the Income Tax Authorities can be used for assessing or reassessing the income of a taxpayer, determining tax liability or for any other purpose related to taxation. Notice u/s 133(6) can be issued only after obtaining the PRIOR APPROVAL of Principal CIT/ CIT/ Principal DIT/ DIT.

- Notice u/s 133(6) is generated by ITD system. Hence, AO do not require to issue the handwritten notice. Also, reply to the notice by the assessee under verification can be done only through Online mode only.

- Officer may during the course of an inquiry or proceeding issue a written notice to any person requiring assessee to provide specific information or documents. This notice should clearly state the purpose for which the information is required.

- It is MANDATORY to submit REPLY for all or any information asked u/s 133(6). Generally, the TIME LIMIT to submit reply to information asked in the notice is up to 15 days from the date of serving of notice u/s 133(6).

- If an assessee who receives a notice under this section, fails to furnish the required information then penalty u/s 272A(2)(c) may be imposed which may be up to Rs 10,000.

The assessee on whom the penalty is proposed to be imposed must be given an opportunity of being heard in the matter by IT authority, only after that order shall be passed of imposing penalty by IT authority. - The information can be called for checking irrelevant of the fact that whether or not any proceeding is pending before the IT authorities or not.

- Notice u/s 133(6) can be given to assesses asking for information relating to:a) any EXEMPTION (u/s 10(14)(i), u/s 10(14)(ii), 10(13A), 10(10AA)) or DEDUCTION (u/s 80C, 80D, 80CCD (1B), 80DDB, 80GG, 80U etc.) claimed by assessee.

b) any rental income, FD, RD, any interest income, Share market transaction such as Sale of Shares & MF, Sale of Land or Building or Both which has been reflecting in AIS Statement of the assessee but he/she has NOT filed the ITR return or has filed the return showing less income than appearing in AIS Statement.

c) SOURCE of INCOME in respect of any purchase of land or immovable property, heavy amount spend on CREDIT CARD TRANSACTION, any large amount of CASH DEPOSIT has been made in Saving or Current account by the assessee.

Here are the detailed examples of this:

(I). Example – 1 –

Mr. A has filed his ITR for the FY 2022-23. In his ITR, his Salary Income is Rs 28,50,000 from which he has claimed exemption u/s 10(14)(i) of Rs 2,51,250 & u/s 10(14)(ii) of Rs 2,04,650 & u/s 10(13A) of HRA of Rs 1,42,000. Mr. A has also claimed deduction u/s 80C of Rs 1,50,000, u/s 80D of Rs 75,000, u/s 80DDB of Rs 1,00,000, u/s 80GG of Rs 60,000 & u/s 80U of Rs 70,000.

Now, here income tax authorities can issue notice u/s 133(6) asking for information of exemption claimed u/s 10(14)(i), 10(14)(ii) & 10(13A) of amount as mentioned above. Also, income tax authorities can ask of deduction proof such as payment made, document evidence of deduction claimed u/s 80C, u/s 80D, u/s 80DDB, u/s 80GG & u/s 80U.

Mr. A need to give the proper explanation of exemption claimed & payment & document proof of deduction claimed. If he failed to give proper explanation & evidence proof of exemption & deduction claimed then it will be deemed that he has falsely claim the exemption & deduction & it will be disallowed. Penalty for misreporting of exemption & deduction can be imposed by income tax authority.

(II) Example – 2 –

Mr. Basu has filed his ITR return for FY 2022-23 for Rs 10 Lakhs as his total income by showing it as Business Income (Gross Receipt or Turnover = Rs 40 lakhs) under the head PGBP. However, in his AIS statement as updated on Income Tax Portal, it is reflecting that he has DEPOSITED CASH of Rs 80 Lakhs in his saving account. Also, he had sold some shares & MF amounting to Rs 7.5 Lakhs.

Now, here income tax authorities can issue notice u/s 133(6) asking for information about the SOURCE of INCOME of differential amount of EXCESS CASH DEPOSIT of Rs 40 lakhs & also about the Sale of shares & MF of Rs 7.5 lakhs & why this SALES from shares & MF has not been shown in the ITR filed by Mr. Basu.

Mr. Basu need to give the proper explanation of about the SOURCE of INCOME of EXCESS CASH DEPOSIT of Rs 40 lakhs had been made which is coming in his AIS Statement & also about NOT showing SALES from shares & MF in the ITR filed.

If Mr. Basu fails to give the proper explanation or the explanation given by him is NOT SATISFACTORY as per the IT authorities, then they can conclude the assessment of Mr. Basu u/s 148 (Income Escaping Assessment) read with Section 144 (Best Judgement Assessment).

It will be treating as UNEXPLAINED CASH CREDIT of Rs 40 Lakhs cash deposit & UNDISCLOSED INCOME of Rs 7.5 lakhs of Sale of shares & MF on which TAX upto 78% (60% basic Tax + 25% Surcharge + 4% Cess) & also interest & penalty could apply.

(III). Example – 3 –

Mr. Devendra has made a CREDIT CARD TRANSACTION of Rs 25 Lakhs & also has a FD of Rs 2.5 Lakhs each in 2 different bank accounts during the FY 2022-23 which is reflecting in his AIS statement as updated on Income Tax Portal, he is having salary income of Rs 25,000 per month.

Mr. Devendra has NOT FILED his ITR return for FY 2022-23 since his salary income although exceeds the basic exemption limit not chargeable to tax but is within the REBATE covered u/s 87A. Hence, he thought that it will be irrelevant for him to file his ITR return.

Now, here income tax authorities can issue notice u/s 133(6) asking for information about the SOURCE of INCOME of CREDIT CARD TRANSACTION of Rs 25 Lakhs & FD of Rs 5 Lakhs during the FY 2022-23, Since Mr. Devendra has NOT FILED his ITR return for FY 2022-23.

Mr. Devendra need to give the proper explanation of about the SOURCE of INCOME of CREDIT CARD TRANSACTION of Rs 25 Lakhs & FD of Rs 5 Lakhs during the FY 2022-23.

If he fails to give the PROPER EXPLANATION or the explanation given by him is NOT SATISFACTORY as per the IT authorities, then they can conclude the assessment of Mr. Devendra u/s 148 (Income Escaping Assessment) read with Section 144 (Best Judgement Assessment) by treating it as UNEXPLAINED EXPENDITURE of Credit Card transaction of Rs 25 Lakhs & UNDISCLOSED INCOME of FD of Rs 5 Lakhs on which TAX upto 78% (60% basic Tax + 25% Surcharge + 4% Cess) & also interest & penalty could apply.

Happy Readings!

Disclaimer: The information contained in this website is provided for informational purposes only, and should not be construed as legal/official advice on any matter. All the instructions, references, content, or documents are for educational purposes only and do not constitute legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this article or for any conclusion of the information.