GST registration process is essential for anyone conducting business in India. GST registration is mandatory for businesses exceeding specified turnover limits. GST registration enables businesses to facilitate seamless inter-state transactions & increases credibility in the eyes of your customers & business partners.

In this article we will be understanding thoroughly about the GST Registration and its Process.

1. What is GST Registration?

– If the Turnover/Gross Receipt/Sales of any business exceeds the prescribed threshold limit (Rs 10Lakhs/ 20 Lakhs/ 40 Lakhs), then the business owner must register under Goods and Services Tax (GST), which is known as GST registration.

– GST Registration is PAN based & State specific. One registration for each State & Union Territory. However, a business entity having separate places of business in a State may obtain separate registration for such places of business.

– Registration under GST is not tax specific, i.e. single registration for all the taxes i.e. CGST, SGST/UTGST, IGST & cesses.

There are 4 main types of Goods and Services Tax registration:

a) Normal Registration: This registration is required when the required aggregate turnover/gross receipt/sales of a business or person exceeds a specified limit of Rs 10Lakhs/ 20 Lakhs/ 40 Lakhs.

b) Compulsory Registration: In specific scenarios, some businesses are required to obtain compulsory registration under GST, regardless of their turnover. For example – Casual Taxable Person (CTP), TDS/TCS deductor, Input Service Distributor (ISD) etc.

c) Voluntary Registration: Businesses that has not applied for compulsory registration can opt for voluntary registration themselves under GST.

d) Registration under Composition Scheme: If the aggregate turnover exceeds the prescribed threshold limit (Rs 10Lakhs/ 20 Lakhs/ 40 Lakhs) but remains below a specified upper limit for opting for composition scheme (Rs 75 Lakhs/ 1.5 Crores), businesses can choose to register under Composition Scheme. Under this scheme, taxpayers pay GST at a fixed rate based on turnover, with simplified compliance compared to normal registration.

2. What is the Threshold limit for GST Registration?

The specified turnover limit of GST regulations depends on the nature & state of the business.

The Turnover limit for businesses supplying goods is higher than businesses providing services. Also, the turnover limit is lowered for some specified states.

| Particulars | Supplier of Goods | Service Providers |

| Turnover Threshold Limit in all Other States (Delhi, Bihar, Maharashtra, Gujarat, Haryana, Chhattisgarh, Jharkhand, Uttar Pradesh, Himachal Pradesh, Karnataka, Madhya Pradesh, Andhra Pradesh, Kerala, Goa, Punjab, Odisha, Rajasthan, Tamil Nadu, West Bengal, Lakshadweep, Dadra & Nagar Haveli & Daman & Diu, Andaman & Nicobar Islands & Chandigarh) | 40 Lakhs Per Annum | 20 Lakhs Per Annum |

| Turnover Threshold Limit for Specified Category States (Arunachal Pradesh, Meghalaya, Sikkim, Uttarakhand, Puducherry, Telangana, Assam, Himachal Pradesh, Jammu & Kashmir) | 20 Lakhs Per Annum | 20 Lakhs Per Annum |

| Turnover Threshold Limit for Specified Category States (Manipur, Mizoram, Nagaland, Tripura) | 10 Lakhs Per Annum | 10 Lakhs Per Annum |

3. Documents Required for GST Registration:

List of document requirement for GST registration:

- PAN card of business/applicant

- Aadhaar card

- Business Registration documents proof or Certificate of Incorporation of business

- Address proof & Identity of Promoters/Directors with photographs & address proof of persons in charge

- Place of business address proof

- Bank statements/Cancelled cheque

- Digital Signature

- Authorization letter copy

Note – There are NO fees prescribed under the GST law for obtaining GST registration on the GST portal.

4. Step by Step Process for taking GST Registration:

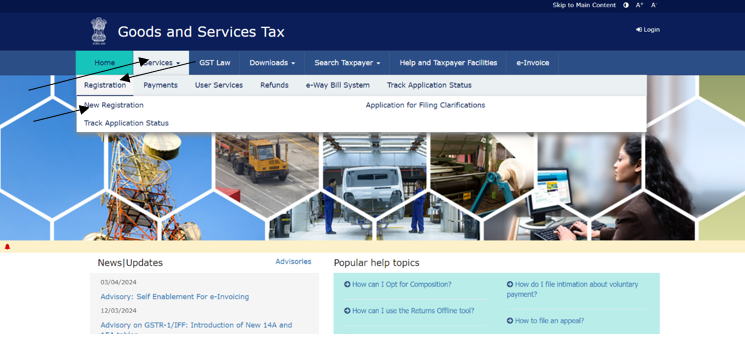

Step 1: Visit the GST portal- https://www.gst.gov.in/ & click on the registration button under the ‘services tab’. After that click on new registration.

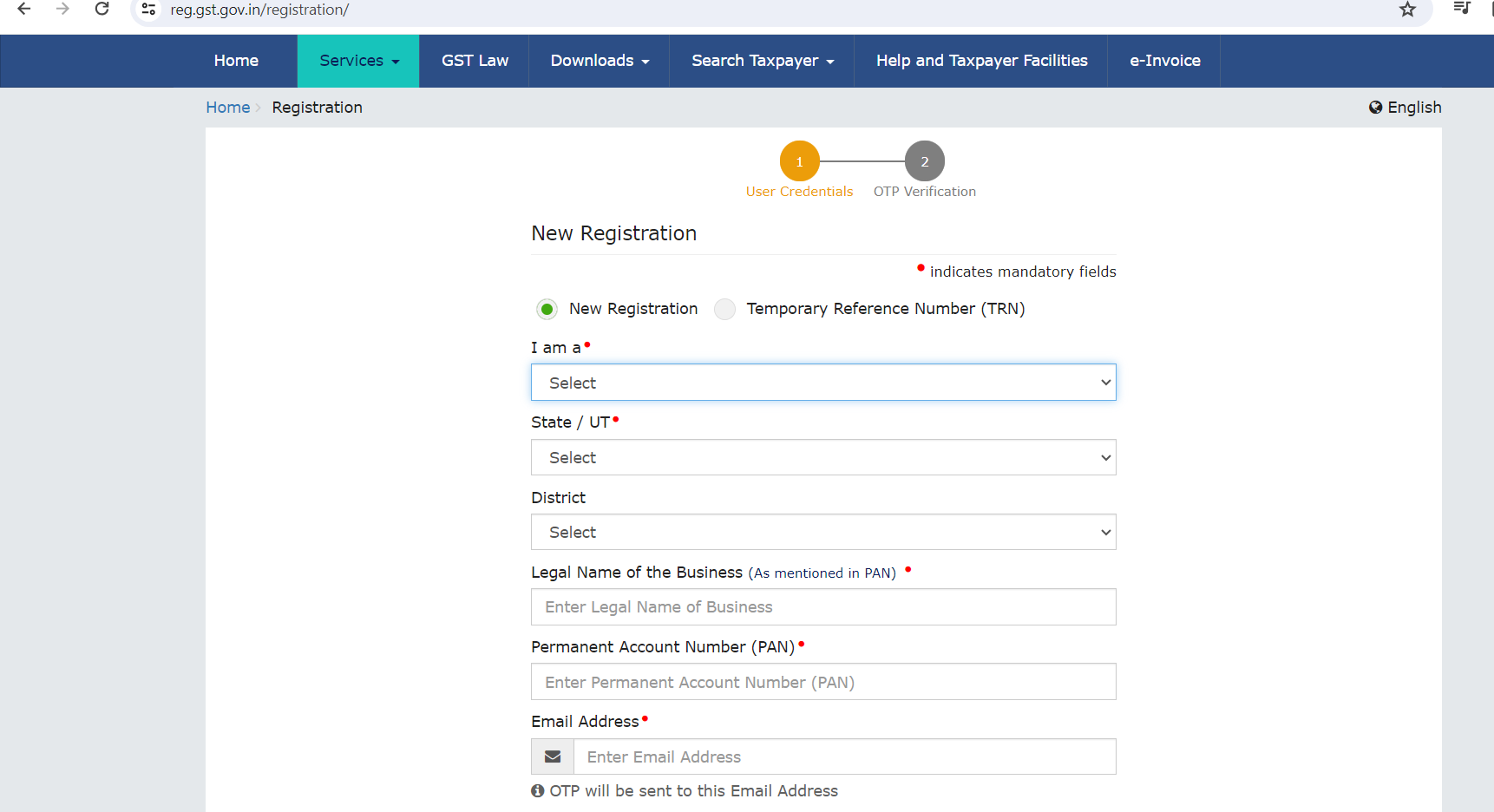

Step 2: The information that has to be filled in here is:

- select “Tax payer” as the type

- Enter your PAN No., email address & mobile number.

- Click on “Proceed” to receive an OTP (One-Time Password) on your registered email address & mobile number for verification.

- Enter the OTP received and click on “Continue.”

- You will be redirected to the Temporary Reference Number (TRN) page.

- Make a note of the TRN as it will be required for the next step of the registration process.

Step 3: Filling in Details for GST Registration:

- Enter the TRN & captcha & then click on “Proceed.”

- You will be redirected to the GST registration form.

- Then Fill the Relevant Details.

- Once all the details & documents are correctly filled, submit the application.

- After submission, an Application Reference Number (ARN) will be generated and sent to your mobile number & email address.

- The application will be verified by the GST authorities & if everything is alright, a Certificate of Registration along with the Goods and Services Tax Identification Number (GSTIN) will be issued to you.

5. Penalty for NOT taking GST registration?

Failing to register under GST can attract penalties & consequences. Penalties are:

- A penalty of Rs 10,000 or 10% of the tax due, whichever is higher, for not registering despite being liable to do so.

- A penalty of Rs 10,000 or the tax amount, whichever is higher, for collecting GST but not depositing it to the government within 3 months from date of collection of GST.

6. Some Other Important Points:

– Multiple GST registrations – Yes, it is possible to have two or more GST registrations under the same PAN. For example – Business entity having separate places of business in a State may obtain separate registration for such places of business.

– Benefits of taking GST Registration –

- Legal recognition of a business

- Uniform accounting of taxes

- Businesses will be eligible to avail of several benefits under the GST regime

- Legal authorization of collecting tax from sales made.

– How much time does it take to Register under GST – The complete GST registration procedure, including receiving the GST number, may take upto 3 to 10 Working Days.

Happy Readings!

Disclaimer: The information contained in this website is provided for informational purposes only, and should not be construed as legal/official advice on any matter. All the instructions, references, content, or documents are for educational purposes only and do not constitute legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this article or for any conclusion of the information.